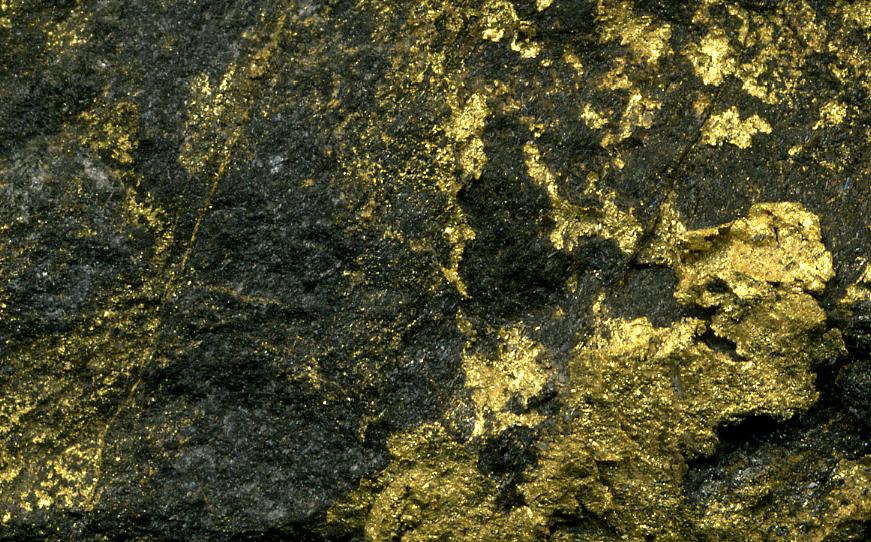

The mining industry is a buzz of activities as companies’ race against time to take advantage of a spike in metal prices. Likewise, companies are increasingly posting impressive financial results attributed to a spike in gold and silver prices.

Centamin Impressive Q3

Centamin (LSE:CEY)(TSX:CEE) is one of the companies that is moving higher after capping yet another impressive third-quarter backed by solid performance. The company generated a free cash flow of $137 million for the three months ended September 30, 2020, backed by a strong balance sheet of $345 million in net cash and liquid assets.

Gold production from the company’s Sukari Gold Mine topped 128 240 ounces. The company generated $230 million from gold sales of 118,617 ounces at an average price of $1933. Year to date, the company has generated $678 million in gold sales. For the full year, the mining company expects to produce 445,000 to 455,000 ounces of gold.

Japan Gold Corp Milestones

Japan Gold Corp (CVE:JG) (OTCMKTS:JGLDF) is another company in a fine run in the aftermath of Gold prices racing to record highs. The company already enjoys a first-mover advantage in japan, whereby it owns 31 gold projects within major epithermal gold province.

It is also the first foreign explorer to focus on the Island nation. In the Hokusatsu region, the company holds 77% of the prospective ground. Early this year, Japan Gold struck a strategic partnership with Barrick Gold to develop 29 of its 31 projects.

Barrick gold has committed to sole fund a two-year initial evaluation of each project and a three-year second phase if the project meets the titan’s criteria. In June, the company completed a financing round raising over 7.5 million, funding that should allow the company to ramp up its exploration efforts.

Dore OTCQB Listing

Separately, Doré Copper (TSXV:DCMC; OTCQB:DRCMF) has started trading on the OTCQB Venture Marketplace. According to the Chief Executive Officer Ernest Mast, listing on the OTCQB marketplace should make the company accessible to a wider pool of U.S investors looking to gain exposure to the industrial metal.